Back to work featuring our recommended products

Revitalising your projects with industry-leading solutions As worksites across Australia gear up for a busy season, having the right gear is...

After some extensions since the introduction in 2011, the instant asset write-off was extended in the Federal Budget in 2021 until 30 June 2023.

The Australian Government introduced the temporary full expensing scheme in 2020 to stimulate business investment and drive economic growth during the pandemic. The incentive will end on 30 June 2023.

Businesses that wish to take advantage of this have until June 30 to purchase and install qualifying assets and claim the costs in the same financial year.

Temporary full expensing was developed to encourage businesses to invest in new assets such as new equipment, machinery, and technology. Eligible businesses can claim an immediate deduction for the full cost of qualifying depreciable assets, rather than claiming deductions over several years.

You are eligible to write off the full amount you spend on an asset used for business purposes in the financial year you purchased it, which equates to an eligible tax deduction for the full cost of the asset.

Assets must cost less than the instant asset write-off threshold and be purchased and used in the year that the write-off is claimed.

If you are a small business, you must use the simplified depreciation rules to claim the instant asset write-off.

The program was designed to stimulate spending and make it easier for small businesses to benefit from asset purchases.

For the 2020–21,2021–22 and 2022-23 income years, an eligible entity can claim in its tax return a deduction for the business portion of the cost of eligible new assets first held, first used or installed ready for use for a taxable purpose between 7.30pm AEDT on 6 October 2020 and 30 June 2023. For more information refer to information on the ATO website on Temporary full expensing here. If your business has a total annual income of less than $2M, you may be able to claim up to 100% of business asset expenses.

Solid record keeping is the foundation to a pain-free experience during tax time. Keeping records for sales and other business income as well as expenses that will be claimed as deductions will make it a much easier process when it comes time to prepare and lodge your return.

Keeping records electronically as well as evidence of all transactions and photos of paper receipts will not only make it easier to lodge your tax return, but can help to manage cash flow and keep better track of how your business is doing.

Qualifying assets need to be delivered, used or installed ready for use on or before the end date for the instant asset write-off which is 30 June 2023.

The information contained here is general in nature and does not constitute tax or financial advice. For more information and to make an informed decision based on your own circumstances, it’s recommended you consult a registered tax agent and refer to the ATO website - ato.gov.au

References:

Revitalising your projects with industry-leading solutions As worksites across Australia gear up for a busy season, having the right gear is...

The challenge: Inefficient inventory and lost productivity. Two large manufacturing facilities were facing mounting challenges in managing their...

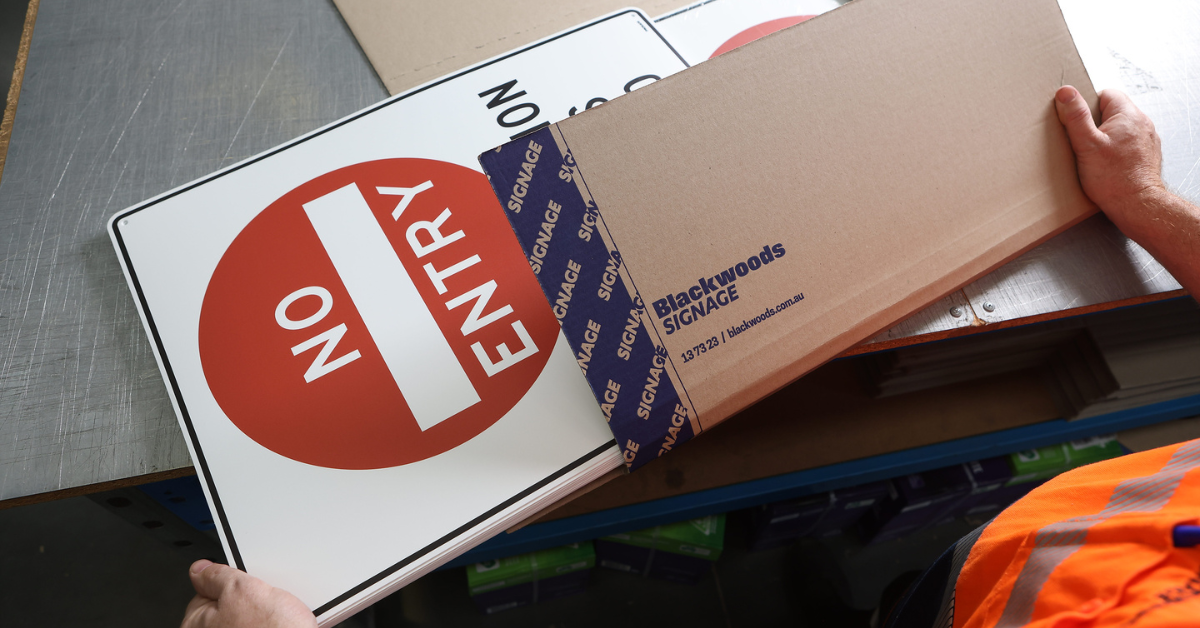

Signage provides vital communication in fast-paced manufacturing environments. Productivity, efficiency and safety depend on well-organised...